For almost 20 years, publishers and search engines worked in a balanced system.

Publishers allowed Google and others to crawl their websites, and in return, search engines sent traffic back. This traffic helped fund journalism through ads and subscriptions.

But AI is breaking this old model.

With AI Overviews, ChatGPT answers, and other “answer engines,” users get answers directly on the platform instead of clicking on publisher websites.

Traffic is falling, while AI companies are crawling more content than ever.

Because of this, publishers and tech companies are now negotiating new payment models—some based on usage, others on flat fees, and some ending in court settlements. Nobody knows yet which model will work long term.

LLM Payments To Publishers: How The Traffic Exchange Has Changed

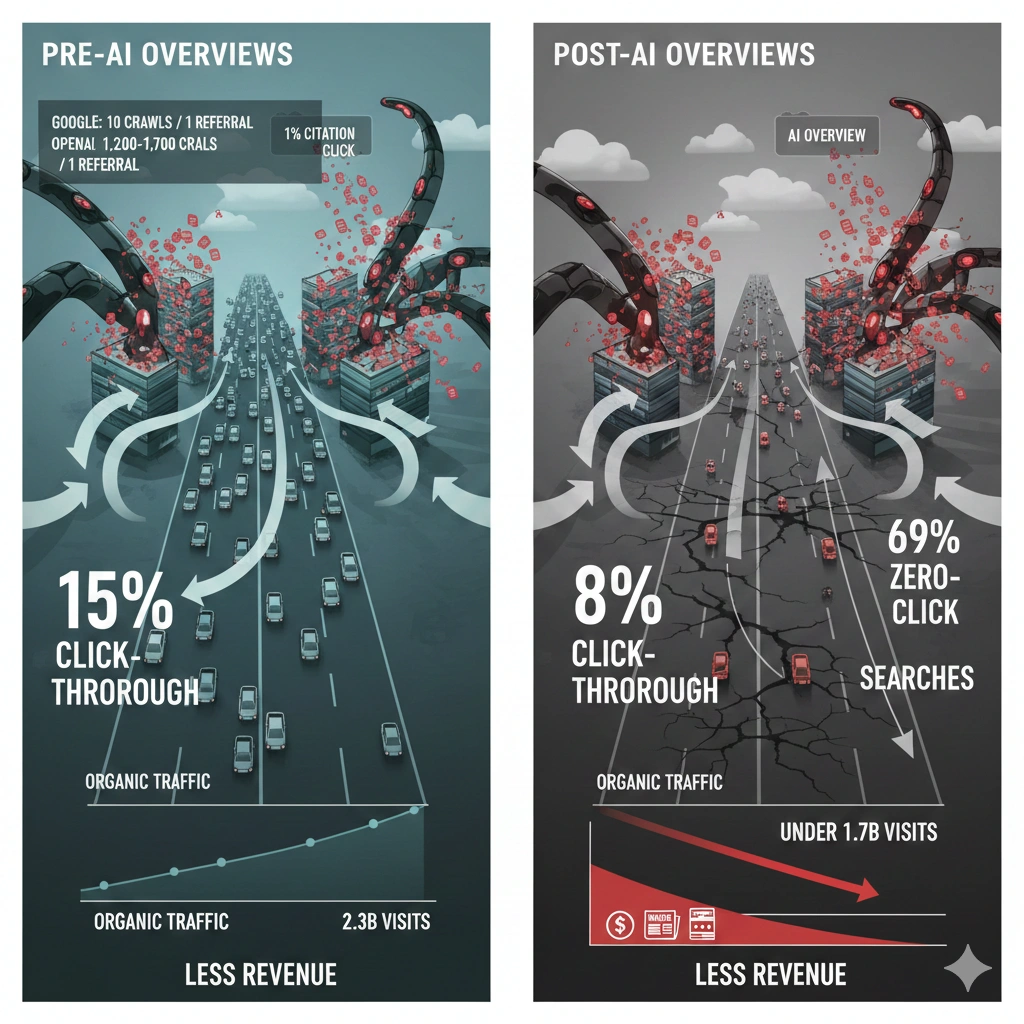

AI Overviews are causing clear traffic drops:

- When AI Overviews appear, only 8% of users click any link (compared to 15% without them).

- Just 1% of users click AI Overview citations.

- Zero-click searches increased from 56% to 69% (2024–2025).

- Organic traffic to U.S. websites dropped from 2.3B to under 1.7B visits.

At the same time, AI crawler activity is rising sharply.

Cloudflare’s data shows:

- Google Search: 10 crawls per 1 referral

- OpenAI: 1,200–1,700 crawls per 1 referral

This imbalance means fewer pageviews, fewer ads, fewer subscriptions, and less revenue.

The New Payment Models

Three main models are starting to appear.

1. Usage-Based Revenue Sharing

- Perplexity’s Comet Plus shares subscription revenue with publishers.

Partners: TIME, Fortune, LA Times, Adweek, Blavity. - ProRata offers a 50/50 split for AI answers using its technology.

Payments depend on how often AI uses an article. But the revenue pool is much smaller than traditional search revenue.

2. Flat Licensing Deals

Several publishers have signed direct deals with OpenAI:

- News Corp: multi-year deal worth hundreds of millions

- Dotdash Meredith: reported $16 million

- Others: Financial Times, The Atlantic, Vox Media, Associated Press

These deals usually include:

- access to archives for training

- permission to show fresh content in ChatGPT

- access to AI tools

Bigger publishers with large archives get better deals; smaller publishers struggle to negotiate.

Microsoft and Google are also making licensing moves with select publishers.

3. Legal Settlements

Anthropic settled with authors for $1.5 billion after a court ruled:

- Training on legally purchased books = fair use

- Training on pirated copies = infringement

This settlement gives a benchmark for future negotiations.

How Publishers Are Responding

Some Publishers Are Accepting Deals

Leaders at Condé Nast and Dotdash Meredith say these deals help replace lost search revenue.

Benefits include:

- new income streams

- legal protection

- influence over AI development

- early partnership advantage

Others Are Going to Court

The New York Times sued OpenAI and Microsoft, calling their actions “unlicensed exploitation.”

Forbes rejected Perplexity’s offer.

More lawsuits have followed from News Corp companies and others.

Reasons for rejecting deals:

- payments too low

- fear of locking in bad terms

- AI summaries compete with original work

Industry Groups Want Regulation

News/Media Alliance and Digital Content Next say AI systems risk harming journalism unless publishers are paid fairly and given transparency.

A New Divide: Licensed Web vs. Open Web

Two classes of content are emerging:

The Licensed Web

- premium publishers

- large archives

- direct pay from AI companies

The Open Web

- content available for free crawling

- limited or no compensation

- includes UGC, marketing content, small sites

This could widen the gap between big publishers and smaller ones.

Also read about: AI Content Creation 2025: Adobe Upgrades GenStudio Tools

How This Shift Is Changing SEO

1. Citations Don’t Equal Clicks

AI answers include citations, but users rarely click them.

SEO experts now focus more on:

- brand searches

- conversions

- direct traffic

- tracking AI citations

2. Bot Access Is Now a Business Choice

Publishers now decide whether to:

- allow AI crawlers for visibility

- block them to protect revenue

- negotiate selective access using tools like ProRata or TollBit

3. Measuring Success Is Harder

Falling traffic raises tough questions for businesses that depend on ads.

Publishers are turning to:

- subscriptions

- newsletters

- events

- affiliate marketing

- apps

4. Content Investment Is Shifting

Publishers with licensing deals may create content tailored for AI training needs.

Smaller publishers must decide whether investing in high-quality content pays off.

The Sustainability Problem

- Staff cuts across newsrooms

- Authors refusing AI training use

- More content going behind paywalls

- Threats to long-term journalism funding

Large publishers with strong brands and diverse revenue streams are doing better. Smaller ones are struggling most.

What’s Next

Current payment models don’t match lost search revenue or reflect how much AI companies benefit from crawling content.

The future depends on:

- upcoming court decisions

- regulatory action

- market pressure

- how AI companies adjust their terms

For now, publishers must make quick decisions about:

- bot access

- content strategy

- diversification

—without knowing which path will be sustainable.

Also Read: